Small business financial loans can provide an essential source of cash to get your startup company going, preserve it running or perhaps expand. Yet , the type of loan you decide on can affect your accomplishment and your economical future.

Classic financing: Companies and other traditional lenders can provide competitive interest levels and lengthy terms. However they are also sometimes difficult to are entitled to and take longer to procedure.

Alternative funding: Fortunately, right now there are options that can make the procedure of getting a business loan much easier and more quickly. These include unsecured loans, business bank cards and choice lenders.

If you have a fantastic network, this kind of financing choice can help avoid the formal application process and reduce the chances of your loan being rejected or delayed. It has important to be aware, though, that this method isn’t often the best choice for all those startups, especially if you have below-average credit or inconsistent revenue.

SBA-backed loans: These kinds of loans are backed by the little Business Supervision and is an excellent choice for businesses that have been in business for at least two years, have a strong credit scores https://providencecapitalnyc.com/2019/12/10/capital-providence-in-the-enterprise and annual income and meet other SBA eligibility standards.

Equipment financial loans: For many small companies, a company equipment financial loan is the easiest way to fund expensive machinery or tools which will help your company develop. These loans can be taken away as a huge or on the line of credit, which means you can get the money when it’s needed.

Small business financial loans can provide an essential source of cash to get your startup company going, preserve it running or perhaps expand. Yet , the type of loan you decide on can affect your accomplishment and your economical future.

Classic financing: Companies and other traditional lenders can provide competitive interest levels and lengthy terms. However they are also sometimes difficult to are entitled to and take longer to procedure.

Alternative funding: Fortunately, right now there are options that can make the procedure of getting a business loan much easier and more quickly. These include unsecured loans, business bank cards and choice lenders.

If you have a fantastic network, this kind of financing choice can help avoid the formal application process and reduce the chances of your loan being rejected or delayed. It has important to be aware, though, that this method isn’t often the best choice for all those startups, especially if you have below-average credit or inconsistent revenue.

SBA-backed loans: These kinds of loans are backed by the little Business Supervision and is an excellent choice for businesses that have been in business for at least two years, have a strong credit scores https://providencecapitalnyc.com/2019/12/10/capital-providence-in-the-enterprise and annual income and meet other SBA eligibility standards.

Equipment financial loans: For many small companies, a company equipment financial loan is the easiest way to fund expensive machinery or tools which will help your company develop. These loans can be taken away as a huge or on the line of credit, which means you can get the money when it’s needed.

Kolom komentar

Artikel lainnya

- What Is POS Program?

- What to anticipate in a VDR for Mum Project

- Guarding Data Right from Unauthorized Gain access to

- Find Your Dream International Asian Bride With Wife-finder Com

- Ways to Install Wi fi Signal Enhancer

- Ideal Free VPN For Google android

- Just what Virtual Data Room?

- What to anticipate in an On the web Data Place

- Ways to Implement a Document Management System

- Microfinance For Small enterprises

Produk yang mudah terjual

-

VS GELAS LIPAT PLASTIK PORTABLE

Rp8.421

VS GELAS LIPAT PLASTIK PORTABLE

Rp8.421

-

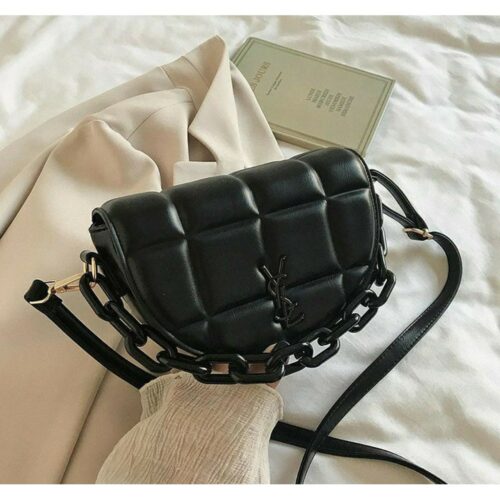

CSB TAS SELEMPANG WANITA VALEN BORDIR RANTAI AKRILIK

Rp8.518

CSB TAS SELEMPANG WANITA VALEN BORDIR RANTAI AKRILIK

Rp8.518

-

FFS Setelan Celana Sweater Flag USA

Rp54.000

FFS Setelan Celana Sweater Flag USA

Rp54.000

-

FFS Setelan Piyama Tidur Waniga Sherly

Rp31.000

FFS Setelan Piyama Tidur Waniga Sherly

Rp31.000

-

FFS Set Piyama Wanita Monkey

Rp36.000

FFS Set Piyama Wanita Monkey

Rp36.000