A private equity firm can be an investment managing company that raises cash from high net worth individuals, institutional investors, and venture capital firms with regards to investing in privately owned companies. The primary goal of a private equity company is always to obtain a positive return on the money invested in these firms.

Private equity finance firms purchase corporations and remodel them to receive a profit after they sell the business enterprise again. The capital for these acquisitions comes from investors inside the private equity funds that the company manages.

These funds are typically illiquid and is very high-risk because they may have high levels of debt. Funds are usually often were able by people who have conflicts of interest, which often can lead to an adverse impact on the returns the fact that the investors in the funds acquire.

The Composition of Private Equity Funds

A personal equity money is organised like a joint venture with Limited Partners (LPs) and Standard Partners (GPs). LPs present about 90% of a private equity finance fund’s capital.

GPs are in charge of for controlling the businesses within the portfolio and reorganization, rearrangement, reshuffling their everyday operations to improve efficiency and develop fresh technological breakthroughs. They are paid out a fee in the LPs with regard to their services, which are usually around 10% in the total value belonging to the portfolio company.

The Most Popular Types of Private Fairness Acquistions

Private equity firms will be most famous for purchasing outstanding servings of private or perhaps struggling public companies, re-doing them to enhance their operations, and offering them for a profit. This practice is known as “buying to sell. ” https://partechsf.com/partech-international-ventures-is-an-emerging-and-potentially-lucrative-enterprise-offering-information-technology-services/ The firms are able to achieve these results due to their expertise in building a great M&A pipeline, disciplined procedures for evaluating targets, and a history of successful bargains.

A private equity firm can be an investment managing company that raises cash from high net worth individuals, institutional investors, and venture capital firms with regards to investing in privately owned companies. The primary goal of a private equity company is always to obtain a positive return on the money invested in these firms.

Private equity finance firms purchase corporations and remodel them to receive a profit after they sell the business enterprise again. The capital for these acquisitions comes from investors inside the private equity funds that the company manages.

These funds are typically illiquid and is very high-risk because they may have high levels of debt. Funds are usually often were able by people who have conflicts of interest, which often can lead to an adverse impact on the returns the fact that the investors in the funds acquire.

The Composition of Private Equity Funds

A personal equity money is organised like a joint venture with Limited Partners (LPs) and Standard Partners (GPs). LPs present about 90% of a private equity finance fund’s capital.

GPs are in charge of for controlling the businesses within the portfolio and reorganization, rearrangement, reshuffling their everyday operations to improve efficiency and develop fresh technological breakthroughs. They are paid out a fee in the LPs with regard to their services, which are usually around 10% in the total value belonging to the portfolio company.

The Most Popular Types of Private Fairness Acquistions

Private equity firms will be most famous for purchasing outstanding servings of private or perhaps struggling public companies, re-doing them to enhance their operations, and offering them for a profit. This practice is known as “buying to sell. ” https://partechsf.com/partech-international-ventures-is-an-emerging-and-potentially-lucrative-enterprise-offering-information-technology-services/ The firms are able to achieve these results due to their expertise in building a great M&A pipeline, disciplined procedures for evaluating targets, and a history of successful bargains.

Kolom komentar

Artikel lainnya

- What Is POS Program?

- What to anticipate in a VDR for Mum Project

- Guarding Data Right from Unauthorized Gain access to

- Find Your Dream International Asian Bride With Wife-finder Com

- Ways to Install Wi fi Signal Enhancer

- Ideal Free VPN For Google android

- Just what Virtual Data Room?

- What to anticipate in an On the web Data Place

- Ways to Implement a Document Management System

- Microfinance For Small enterprises

Produk yang mudah terjual

-

VS GELAS LIPAT PLASTIK PORTABLE

Rp8.421

VS GELAS LIPAT PLASTIK PORTABLE

Rp8.421

-

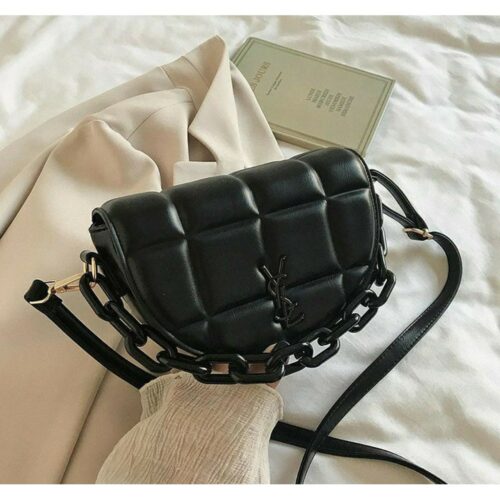

CSB TAS SELEMPANG WANITA VALEN BORDIR RANTAI AKRILIK

Rp8.518

CSB TAS SELEMPANG WANITA VALEN BORDIR RANTAI AKRILIK

Rp8.518

-

FFS Setelan Celana Sweater Flag USA

Rp54.000

FFS Setelan Celana Sweater Flag USA

Rp54.000

-

FFS Setelan Piyama Tidur Waniga Sherly

Rp31.000

FFS Setelan Piyama Tidur Waniga Sherly

Rp31.000

-

FFS Set Piyama Wanita Monkey

Rp36.000

FFS Set Piyama Wanita Monkey

Rp36.000